Forex Trading Scams: How to Identify and Avoid Them

The allure of forex trading has attracted millions of individuals looking to make quick profits. However, this lucrative market is not without its dangers. forex trading scam https://onlinetrading-cm.com/ is a valuable resource for those who want to navigate forex trading safely. Unfortunately, alongside genuine opportunities, numerous scams exist that prey on inexperienced traders. This article will explore common forex trading scams, their characteristics, and how to protect yourself from falling victim to them.

Understanding Forex Trading

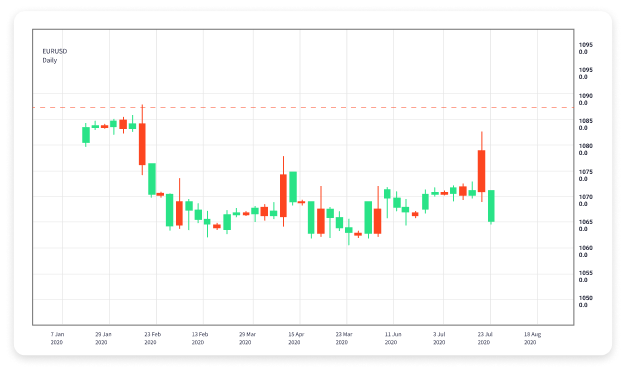

Forex, or foreign exchange, refers to the global marketplace for trading national currencies against one another. With a daily trading volume exceeding $6 trillion, it is one of the largest financial markets in the world. Traders invest in this market with the hope of profiting from fluctuations in currency values.

The simplicity of trading, combined with the potential for high returns, makes forex an attractive option for traders. However, it is also this very appeal that attracts scammers. Therefore, understanding how forex trading works is crucial in distinguishing legitimate trading opportunities from scams.

Common Types of Forex Trading Scams

Many types of forex trading scams exist. Below are some of the most common ones to be aware of:

1. Fake Brokers

One of the most prevalent scams involves fraudulent brokers who claim to offer forex trading services. These fake brokers often set up realistic-looking websites that promise high returns with minimal risk. After convincing traders to deposit funds, they either disappear or manipulate the trading platform to ensure the trader loses their investment.

To avoid falling for such scams, always verify the broker’s regulatory status. Reputable brokers are usually registered with a financial regulatory authority, which ensures they adhere to strict guidelines.

2. Signal Selling Scams

Another common scam is the selling of trading signals. Scammers claim to have insider knowledge or advanced algorithms that will guarantee profits if traders follow their recommendations. While some genuine signal providers exist, many simply charge for access to ineffective or misleading information.

Before purchasing signals, research the provider’s track record. Trustworthy signal providers offer transparency about their past performance.

3. Ponzi Schemes

Ponzi schemes lure investors with promises of high returns and minimal risk. Essentially, money from new investors is used to pay returns to earlier investors, creating the illusion of a profitable business. However, once the scheme can no longer attract new investors, it collapses, leaving many without their investment.

Always be cautious of investment opportunities that seem too good to be true. If a returns promise sounds unrealistic, it probably is.

4. Forex Robots and Automated Trading Systems

Forex robots and automated trading systems are tools that some traders use to execute trades on their behalf. However, many scams involve selling these systems by making exaggerated claims about their success rates. In reality, most automated systems do not perform as advertised and can result in significant losses.

If you are considering using automated systems, conduct thorough research and read independent reviews before investing.

Recognizing Red Flags

To protect yourself from forex trading scams, it’s essential to recognize certain red flags. Here are some warning signs to watch for:

– **Unrealistic Promises**: If it sounds too good to be true, it likely is. Be wary of promises of high returns with little to no risk.

– **Lack of Regulation**: Always verify that the broker or trading platform is regulated by a well-known financial authority.

– **Pressure to Invest Quickly**: Scammers often create a sense of urgency, pressuring you to invest without taking the time to do your research.

– **Poor Customer Service**: Reputable brokers provide clear and accessible customer service. If you encounter difficulty contacting customer support, it’s a possible red flag.

– **Complex Terms**: If the trading strategy or investment structure is overly complicated and difficult to understand, it may be designed to confuse and mislead you.

Protecting Your Investments

Knowledge is your best defense against forex trading scams. Here are some strategies to help you protect your investments:

– **Conduct Thorough Research**: Before ensuring any investment, research the broker or trading platform. Look for reviews from other traders and verify their regulatory status.

– **Educate Yourself**: Take the time to learn about forex trading and the associated risks. The more knowledgeable you are, the better decisions you can make.

– **Start Small**: If you’re new to forex trading, start with a demo account or invest a small amount of capital until you gain experience.

– **Seek Professional Advice**: If unsure, consult with a financial advisor who has a good reputation in the industry. They can offer guidance and help you identify any potential scams.

– **Stay Informed**: Keep yourself updated on the latest developments in forex trading and the types of scams that are currently being reported.

Conclusion

The forex trading market offers great potential for profit, but it is also rife with scams that target unsuspecting investors. By understanding the common types of forex scams and recognizing red flags, you can safeguard your investments and avoid falling victim to fraudulent schemes.

Always exercise caution, conduct thorough research, and rely on reputable sources and platforms. If in doubt, trust your instincts and seek advice from professionals or well-informed peers. With the right approach and knowledge, you can navigate the forex market successfully and profitably.